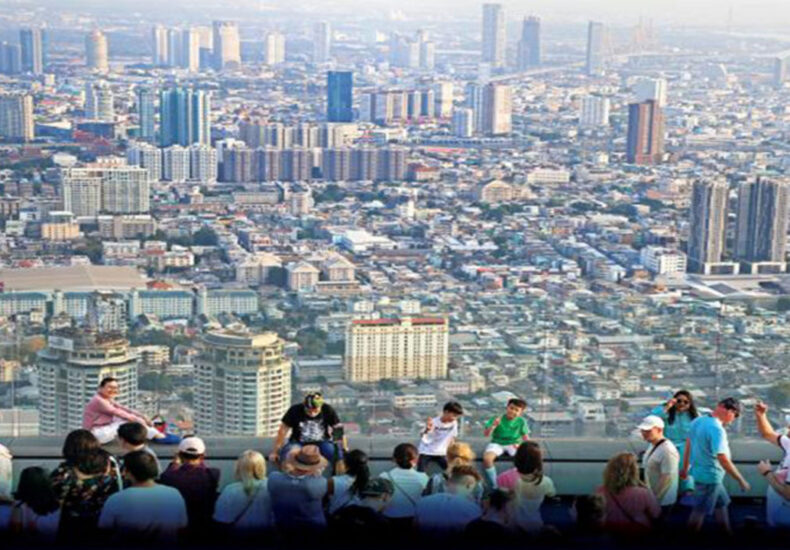

Thailand’s Hotel Sector Faces Pricing Pressure Amid Decline in Chinese Tourists

Fundacion Rapala – Thailand’s hotel sector is experiencing significant pricing pressure in 2025, following four consecutive years of steady rate increases that nearly doubled average room prices since 2021. According to Tris Rating, the current decline is largely due to a sharp drop in tourist arrivals from China and other key Asian markets that traditionally sustain Thailand’s hospitality industry.

Tourist Arrivals Expected to Decline

In its latest Industry Spotlight report, Tris projected total foreign arrivals at 33.1 million this year, a 5.6% drop compared to 35.5 million in 2024. The slowdown is most visible in markets like China, Malaysia, and South Korea—countries that have long served as Thailand’s primary sources of tourists.

Ministry Data Confirms a Sluggish Trend

The Ministry of Tourism and Sports reported that during the first eight months of 2025, international arrivals declined by 7.2% year-on-year, totaling 21.9 million visitors. This slowdown illustrates how deeply the sector is affected, despite efforts to promote Thailand as a leading global tourism hub.

India Emerges as a Growing Source Market

Offsetting the decline somewhat, tourist arrivals from India have surged. India has now become one of Thailand’s top five source markets, supported by strong connectivity with over 15 Indian cities offering direct flights to Bangkok and Phuket.

Long-Haul Markets Show Strength

Meanwhile, long-haul markets remain robust. U.S. arrivals grew by 7.4% year-on-year, while European visitors increased by 15.6%. These figures cement Thailand’s position as the top summer holiday destination for European travelers on Agoda for two consecutive years.

Geopolitical Tensions Add Risks

Tris also flagged the recent Thailand-Cambodia border conflict as a potential risk factor. If prolonged or intensified, it could negatively impact both domestic and international tourism, further straining the already pressured hotel industry.

Declining Demand Meets Rising Competition

Hotel occupancy reached a post-pandemic peak in 2024, surpassing pre-pandemic levels. However, momentum is unlikely to continue in 2025. Weaker international arrivals, cautious consumer sentiment, and growing competition are forcing operators to lower room rates. Tris projects overall occupancy to remain flat or slightly decline this year.

Post-Pandemic Surge Reverses

The post-pandemic boom, driven by pent-up demand and strong domestic travel, has now reversed. The downturn is most evident in Bangkok’s upscale properties, where competitive discounting, unpublished promotions, and selective rate cuts have become necessary to maintain occupancy during low seasons.

Sharp Decline in Chinese Arrivals

Chinese tourist arrivals are expected to drop to 4.6 million this year, compared with 6.7 million in 2024. This follows a 35% plunge recorded in the first seven months of 2025. The loss of Chinese travelers—long Thailand’s most vital market—poses a serious challenge for hoteliers.

China’s Shift to Alternative Destinations

Chinese tourists are increasingly choosing alternative destinations. Japan recorded nearly 70% growth in arrivals from China, boosted by a weaker yen and the appeal of short-haul travel. Vietnam also experienced a 78% surge, making it a major competitor for regional tourism spending.

Risk of Permanent Shift in Travel Preferences

Tris warned that if Chinese arrivals to Thailand do not rebound after China’s National Day holiday in October, it could signal a permanent shift in travel preferences. This would fundamentally reshape Thailand’s tourism landscape and reduce its reliance on the Chinese market.

Hotel Revenues Under Pressure

According to Maybank Securities (Thailand), revenue per available room (RevPAR) among seven listed hotel operators is forecast to contract by 3% year-on-year in Q3, a slight improvement from the 5% decline recorded in Q2.

Outlook for Q4 Remains Negative

Analyst Boonyakorn Amornsank noted that RevPAR is likely to remain negative in Q4 due to weak short-haul demand, a 7% year-on-year increase in hotel supply in Bangkok, and additional disruptions from hotel renovations. This combination of factors will make recovery even more challenging.